LLC for OnlyFans: When It Makes Sense

If you’re building OnlyFans as a real business, at some point you’ll start thinking: “Should I form an LLC?” Not because it’s trendy, but because your income...

If you’re building OnlyFans as a real business, at some point you’ll start thinking: “Should I form an LLC?” Not because it’s trendy, but because your income, privacy needs, brand deals, and stress level change when you go from “testing it out” to “this is paying my bills.”

An LLC can be a smart move for some creators, and a pointless (sometimes expensive) headache for others. This guide will help you decide based on your situation, not hype.

Disclaimer: This is educational, not legal or tax advice. Laws, platform policies, and filing requirements can change. Verify details with your state, the IRS, and a qualified attorney or CPA.

What an LLC actually does (and what it doesn’t)

An LLC (limited liability company) is a business structure registered with your state. It’s mostly about separating your business life from your personal life.

What an LLC can help with

- Business separation: You run income and expenses through a dedicated entity, which can make bookkeeping, budgeting, and paying yourself cleaner.

- Professional credibility: Some brands, vendors, and collaborators take you more seriously when you can invoice as a company.

- Team and outsourcing: If you’re paying editors, assistants, photographers, or an agency, the paper trail and contracts can be more straightforward.

What an LLC does not automatically solve

- It doesn’t “hide you” by default. Many states show ownership info in public records. An LLC name does not guarantee anonymity.

- It doesn’t replace platform verification. OnlyFans and similar platforms typically require identity verification for the creator. Creating an LLC does not mean you can skip that.

- It doesn’t magically reduce taxes. An LLC can be taxed in different ways, but “LLC = less tax” is a common internet oversimplification.

If privacy is your main fear, read this first: How to secretly promote your OnlyFans (without friends or family finding out). An LLC can be part of your privacy plan, but it’s not the whole plan.

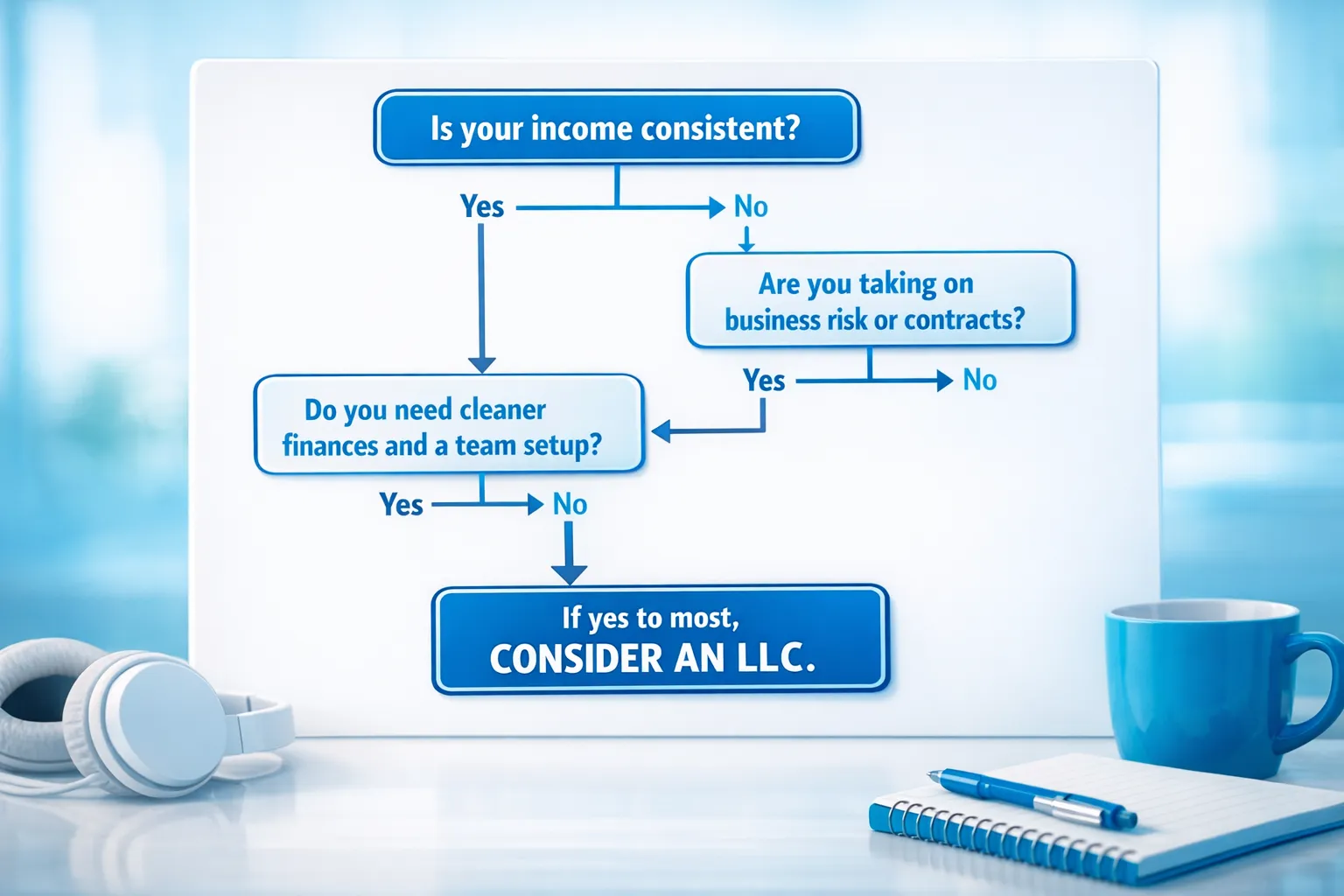

LLC for OnlyFans: a simple decision framework

Here’s the most practical way to decide. If you say “yes” to most of these, an LLC starts making sense.

Test 1: Is your income consistent enough to justify the admin?

If your OnlyFans is still in the “some months are $200, some months are $2,000” phase, an LLC might be premature.

An LLC often comes with:

- State filing fees and sometimes annual report fees (varies by state)

- Ongoing admin (separate bank account, bookkeeping discipline)

- Possibly higher CPA costs if you add complexity

A good rule of thumb is not “hit a certain number,” but hit consistency. If you’re consistently profitable and you plan to keep going for at least the next 12 months, you’re more likely to benefit.

Test 2: Are you signing deals or taking on “real” business risk?

LLCs become more relevant when you:

- Sign brand deals, UGC contracts, sponsorships, collabs, or licensing agreements

- Pay other people regularly (chat support, editing, management)

- Buy equipment and tools that you’d rather keep clearly “business-owned”

If you’re still solo, low volume, and not signing anything, you may not need an entity yet.

Test 3: Do you need cleaner boundaries between “you” and “the business”?

This is the part creators rarely talk about, but it’s real.

If you’re a woman juggling:

- A day job

- a partner or family life

- privacy boundaries

- and a growing subscriber base that wants access 24/7

Then reducing chaos matters.

An LLC can support that “I run a business” mindset, especially when paired with systems like tracking links and structured marketing. If you haven’t set up tracking yet, this is worth bookmarking: OnlyFans tracking links guide.

When an LLC makes sense for OnlyFans creators (common scenarios)

You’re making enough that bookkeeping is getting messy

If your bank account is a blur of:

- lingerie receipts

- subscriptions to editing apps

- travel costs

- props

- and then your rent and groceries

You’re going to feel it at tax time.

Even before “tax strategy,” an LLC can push you to build clean systems:

- separate bank account

- consistent expense tracking

- a simple “pay yourself” routine

You’re building a brand beyond OnlyFans

If you’re expanding to:

- Fansly

- OFTV

- clip stores

- brand collabs

- paid communities

Then you’re not just “an OnlyFans page,” you’re a media business.

Lookstars talks about platform expansion in our management approach (OnlyFans plus alternatives), and if you’re thinking that way already, an entity can support the bigger plan: Lookstars Agency.

You’re ready to outsource (and want contracts to feel safer)

When you outsource, you want clarity:

- who owns the content

- who has access to accounts

- what happens if you stop working together

An LLC won’t automatically protect you from bad partners, but it often encourages more professional agreements.

If you’re hiring help, also read: 6 red flags to watch out for before signing with an OnlyFans agency.

When an LLC might NOT be worth it (yet)

You’re just starting and still validating your niche

If you’re still figuring out:

- what content style you enjoy

- what boundaries feel sustainable

- what pricing works

- whether you even like doing DMs

Then adding paperwork can be a distraction.

A better “first” business move is often tightening your monetization system. Example: improving PPV structure and messaging flow typically impacts revenue faster than entity setup. If pricing is your weak spot, see: How much to charge for PPV on OnlyFans.

Your state has high ongoing costs

Some states have higher annual fees, extra filings, or more complex rules. That doesn’t mean “don’t do it,” it means factor it into your decision.

If you’re not ready to maintain the entity properly, it can become a recurring stressor.

You want anonymity, but you haven’t checked public record rules

Creators sometimes form an LLC thinking it keeps their name off everything.

Reality: LLC privacy depends heavily on your state and filing setup. Many filings become public record, and some require listing members or managers.

If anonymity is the goal, talk to a professional about what’s realistic for your state, and focus on proven privacy basics first (geo-blocking, separate accounts, metadata removal). This privacy guide is a solid starting point: Promote your OnlyFans in secret.

LLC vs staying a sole proprietor: what changes?

Here’s a clear comparison for OnlyFans creators.

| Topic | Sole proprietor (no LLC) | LLC |

|---|---|---|

| Setup | Usually automatic (you start earning) | State filing + ongoing compliance |

| Business finances | Can be mixed unless you’re disciplined | Easier to separate if you use dedicated accounts |

| Brand deals + contracts | Often signed personally | Can sign as the company (depends on counterparty) |

| Privacy | Your legal name may appear on invoices/banking anyway | LLC name can be used publicly, but ownership may still be public |

| Taxes | Typically reported personally (jurisdiction-dependent) | Often still reported personally by default, with options to elect different tax treatment in some countries/states |

| Admin load | Low | Medium, sometimes high if you add payroll/team |

If you want official background on how LLCs work in the US, start with the SBA overview of business structures and confirm state-specific details on your state’s business filing site.

The OnlyFans-specific “LLC pitfalls” creators get blindsided by

Payout and banking realities

Even if you have an LLC, you may still need:

- personal identity verification on platforms

- payout accounts that match required verification details

Platform payout rules and supported business payout options can vary by region and can change, so verify inside your payout settings and official documentation.

“Business expenses” that are not as simple as TikTok says

Yes, creators can have legitimate business expenses. But the exact rules depend on your situation, and aggressive write-offs can backfire.

The best move is boring and safe:

- track everything

- separate personal and business spending

- ask a CPA what applies to your facts

Thinking an LLC replaces contracts

It doesn’t.

If you work with:

- photographers

- editors

- agencies

- chat support

- collaborators

You still want clear terms on access, ownership, confidentiality, and exit.

(If you’re considering management support, this explains what a real manager should do: What can an OnlyFans manager really do for you?)

LLC setup checklist for OnlyFans creators

Keep it simple. Your goal is not to be a corporate lawyer, it’s to reduce risk and run cleaner operations.

- Pick the state where you’ll form the LLC (requirements and fees vary).

- Choose a name that you’re comfortable using on invoices and brand emails.

- Decide who will be listed on filings and what becomes public record in your state.

- Consider a registered agent (common for compliance and sometimes privacy).

- Draft an operating agreement, even if you’re solo.

- Get an EIN from the IRS (free via the official site): IRS EIN application.

- Open a dedicated business bank account.

- Set up a bookkeeping system (spreadsheet is fine at first, consistency matters more than fancy tools).

- Create a “pay yourself” routine so your personal budget stays stable.

- Ask a CPA about tax filing basics and what to set aside (especially if your income fluctuates month to month).

Questions to ask a CPA or attorney (bring this to a consult)

These questions protect you from generic advice and help you get answers specific to adult creators.

- In my state, will my name and address be public if I form an LLC?

- What is the cheapest compliant way to keep my address private?

- If I’m paid by OnlyFans personally, does the LLC still help, and how?

- What bookkeeping setup do you recommend for creators with subscription income plus PPV/customs?

- What expenses are commonly legitimate for content creators in my situation?

- If I hire help (editing, chatting, assistants), what paperwork do I need?

- If I work with an agency, should the contract be with me personally or the LLC?

FAQ

Do I need an LLC to start OnlyFans? No. Many creators start as individuals and only consider an LLC once income becomes consistent, outsourcing begins, or brand deals increase.

Will an LLC protect my identity on OnlyFans? Not automatically. Platform verification typically still requires your real identity, and many LLC filings are public record. Privacy depends on your state and how you set things up.

Will an LLC lower my taxes as an OnlyFans creator? Not automatically. Tax outcomes depend on your location, income, deductions, and whether you make any tax elections. Talk to a CPA for advice tailored to you.

When is the best time to form an LLC? Often when you have consistent profit, you’re signing deals, you’re outsourcing, or you want cleaner separation between personal and business finances. If you’re still experimenting, it can be too soon.

Can I run OnlyFans under an LLC name? You can brand under a stage name and use an LLC for business operations, but verification and payout rules may still require personal details. Check OnlyFans settings and official documentation for your region.

Want a business setup that actually scales (without burning you out)?

An LLC can be a smart step, but it won’t fix weak traffic, inconsistent conversion, leaky content, or the “I’m glued to my DMs all day” problem.

Lookstars helps creators build the systems that usually make the LLC decision feel obvious later: multi-platform marketing, 24/7 fan chatting, posting strategy, privacy setup, and content leak protection.

If you’re serious about treating this like a real business (and want support without upfront costs or long-term contracts), explore Lookstars Agency and apply through the site when you’re ready.

Ready to transform your career?

Join hundreds of creators already earning six figures with Lookstars Agency.

Share this article

Best OnlyFans Agency

Europe's Leading OnlyFans Management Agency.

100% Free Ebook

Get our guide and unlock the secrets to OnlyFans success.

Continue reading...

How to Withdraw Money from OnlyFans in Thailand

OnlyFans in Chile: Earnings, Taxes & Legal Overview